Customs and Excise

Customs Management Act

The Customs Management Act came into operation on 1 July 2012, iterating the customs laws, procedures and mandate empowering the customs officers to discharge their duties in line with the recommended international best practices, including the traders and the public in general when importing or exporting goods in and out of Seychelles.

Customs Division

The Customs Division of the Seychelles Revenue Commission is managed by the Commissioner of Customs and consist of seven sections as follows:

Airport Passenger Terminal

The primary responsibility of the airport passenger terminal customs team is to enforce border protection. Duties at the passenger terminal includes enforcing laws relating to illegal trade activities, preventing the entry of prohibited goods into the country, ensuring effective customs control when clearing incoming passengers and their luggage through the red and green channel.

Monitor, inspect and examine incoming and outgoing goods through airfreight. Conduct customs transactions for clearance of goods permitted to enter into the country. Determine and collect customs value, duties and related fees according to the legislation

Comprises of three sub-units as follows:

- Entry Processing – Verifies and ensures all declarations submitted in the ASYCUDA World System are in line with customs regulations and procedures so that the correct revenue is collected.

- Query, Amendment and Classification – Liaises with importers to amendment their declarations to capture the right amount of duties and taxes to be collected upon importation of goods.

- Classification, Valuation and Rules of Origin – Administers free trades agreements (FTAs) and bilateral agreements of which Seychelles is party to, permitting traders to benefit from lower or eliminated tariff on qualifying products being traded on the international market, that meets the rules of origin requirements. Seychelles is party to the COMESA FTA, SADC FTA and AfCFTA and has entered into bilateral agreement with the United Kingdom, and the European Union interim Economic Partnership Agreement (iEPA) with Eastern and Southern Africa (ESA).

- The unit also administers:

- The domesticated WTO valuation agreement and provide advance ruling or Binding Tariff and Origin Information.

- The functional requirement of the ASYCUDA World to facilitate the smooth implementation of tariff and non-tariff legislation.

- Assesses, certify, authenticate and endorse Certificates of Origin.

The seaport enforcement unit consist of one main unit and two sub-units as follows:

- Examination (main unit) – Verifies goods declared against revenue collected and ensure all relevant permits as well as necessary documents are enclosed with the bill of entry upon importation of restricted goods prior cargo examination. Verifiy all bill of entry placed in the red lane for 20ft and 40ft containers inclduing cargo with less than a container load (LCL). Refer cases relating to undervalued, undeclared, surplus and misclassification of cargo to investigation unit for further evaluation. Issue notice of seizure to importers and entities importing prohibited goods.

- Government Warehouse – Manages entry and storage of un-cleared, seized, confiscated, prohibited, abandoned and deposited goods from the airport passenger and cargo terminal, post office and seaport. Issues notifications to importers for collection of goods in addition to verifying all documents including the bill of entry and the cargo at the warehouse to collect rent charges and applicable taxes upon release of goods.

- Seychelles Post Office – Examine parcels for taxable, prohibited and restricted goods and in cases where an import permit or a bill of entry is required, ensures customs formalities are followed plus liable duty and taxes are paid before the parcel is released to the owner.

Conducts a structured evaluation of a trader’s commercial systems, processes, financial and non-financial records, physical stock, at the traders’ location or at Customs premises, after the release goods from customs control to measure the traders’ compliance against customs laws and regulations.

Comprises of five sub-units as follows:

- Excise-Inspect premises of registered manufacturers of excisable goods, ensuring excise duties are levied and are correctly being paid. Conducts stock-taking, and oversee the production including movement of goods entering and leaving the excise warehouse.

- Bond-Keep records of all goods warehoused and ensures all duties and relevant taxes are collected before delivery of the goods. Oversees the receipt, racking, and transfer of goods for all duty-free shops in adherence to customs laws and regulations. Verifies the duty payments on dutiable sale.

- Concession-Verify, monitor and manage duty-free goods imported into the country, in addition to processing the tax payable (if any) on goods cleared from duty-free following site visits. The unit also oversees concessions applied on imported goods for certain sectors, such as education, tourism, health, diplomatic corps, agriculture, fisheries and others.

- Recovery-Negotiate and recover payments from taxpayers’ having outstanding debts.

- Refund- Investigate, evaluate and determine the eligibility of claims to be refunded.

Excise Tax

Excise Tax is the tax imposed on certain locally manufactured or imported goods, mainly alcohol, cigarettes, motor vehicles, fuel and lubricants.

Application of License – Excise Manufacturer or Excise Bonded Warehouse Operator

A person intending to manufacture excisable goods or store excisable goods to supply to ships, aircraft chandler or for exportation under a tax suspension arrangement, will be required to register their activity with the Seychelles Revenue Commission (SRC) at the Excise Tax Unit of the Customs Division to obtain a license to practice the above mentioned activity. The person will also need to register their business activity with the SRC’s Domestic Tax Division for tax purposes.

Registration Process

Any manufacturer of excisable goods or operator of an excise bonded warehouse is subject to payment of excise tax. As there is no threshold on the company size when it comes to excise tax declaration, a manufacturer of excisable goods or operator an excise bonded warehouse must register, declare and pay the excise tax regardless of the size of the business.

An applicant registering for excise duty must apply to the Commissioner of Customs and must furnish the following information:

- Applicant’s personal details including address and contact number.

- Applicant’s commercial registration numbers to be registered for excise purposes.

- Details of intended excise activities either importing or manufacturing of excise goods.

- Type of excise goods.

- The manufacturing process of excise goods the applicant proposes to adopt; and

- The production capacity of the registered production center as the Commissioner may require.

- The premises where the machinery and equipment of the goods liable to excise tax will be manufactured; and

- Details of the excise warehouse, which shall be part of the registered production center, where all manufactured goods, shall be stored before removal.

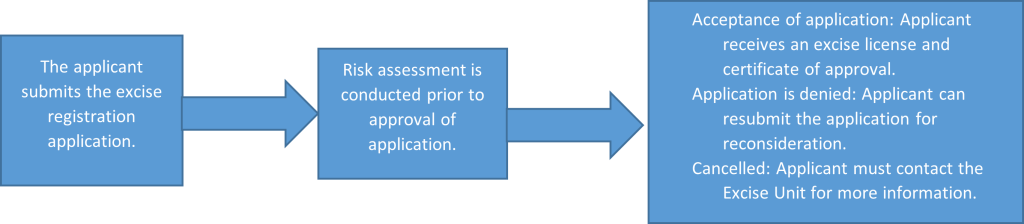

Following submission of the requested information, a risk assessment will be made by the relevant authority to determine the eligibility of the application and approval of excise activity.

The excise manufacturer or excise bonded warehouse operator will only be issued with a certificate of registration if:

- The Commissioner of Customs is satisfied that the person will carry on the business of manufacturing excisable goods and will comply with the obligations imposed under the Excise Tax Act on registered manufacturers;

- The applicant has satisfied the conditions under Section 8 of the Excise Tax Act and has entered into an excise manufacturer’s bond, which shall remain in force while the manufacturer remains a registered manufacturer, with security in an amount determined by the Commissioner; and

- The applicant has paid the prescribed administration fee.

Note, the Commissioner for Customs may cancel the registration of a manufacturer, if the holder of the registration certificate contravenes or fails to comply with any of the conditions of the certificate or if the holder of the registration certificate is convicted of an offence under the Excise Tax Act or other revenue laws.

Application Process Simplified

Amendments in Application

In case of any changes to the information listed in the registration application, the excise registrant must ensure to inform the authority in advance of the changes. The registrant has to submit an application to update the registration information available on SRC system before the changes becomes effective and no later than 30 days after the changes have taken effect.

Obligations of Registered Excise Taxpayers

Registered excise taxpayers must:

- Submit an excise declaration and pay the tax due on or before the 21st day of the following the applicable month of which the sale has taken place.

- Keep a register of inventory of the taxable products manufactured. The inventory register shall indicate the quantity of products exported, sold for domestic consumption, placed in duty-free shops and transferred from one approved warehouse to another. The register stall also include the quantity of goods destroyed, discarded or burnt so that remaining the quantities within the warehouse can be verified accordingly.

- Keep a register showcasing the sales of all taxable products manufactured and stored including the price and quantity of products sold to customer’s by keeping records of the customer’s name and address.

- Keep a register of raw materials to be used in the manufacturing of the excise goods.

- Keep a register showing the activities of the manufacturer that is the date and time of starting and ending work, the names nature of the equipment used, the type and quantity of the raw materials used and the batch number of production as well as the quantity of the goods produced.

- Notify the Seychelles Revenue Commission (SRC) of any movement and or structural changes in the business premises.

- Notify SRC within ten days of any interruption in the manufacturing activities.

Tax Rate

To view the excise tax rates applicable on the certain goods please click here.

Excise Tax Valuation Method

The rates of excise tax can be charged as ‘specific’ that is on a certain amount of tax per unit of the product or as ‘ad valorem’ that is on a percentage of the taxable value of the product.

- Example of a specific excise tax charge – The excise tax charged on whiskies in Seychelles is at the rate of SCR 268.40 per liter

- Example of an ad valorem excise tax charge – The excise tax charged on lubricating oil in Seychelles is at 5% of the taxable value.

Excise Bonded Warehouse Tax Liabilities

Excise tax is generally payable on anything removed from or consumed within the bonded area including:

- Tasting samples

- Promotional giveaways

- Donations

- Free supplies

- Bonus supplies

Excise Tax Exemptions

Excise Duty will not be charged on excisable goods if:

- The goods are exported immediately after they leave the manufacturing area.

- The goods are being moved from one excise warehouse to another excise warehouse.

- The goods have been removed temporarily from the manufacturing process and have been returned to the manufacturing area.

- The goods are used as legitimate manufacturing samples, for example in the laboratory for testing and quality control.

- The goods are being sold to members of diplomatic corps as approved by the Department of Foreign Affairs.

Imposition of Sugar Tax on Drinks

In April 2019, additional rates were applied under Excise Tax as Sugar Tax, as specified in the Statutory Instrument (SI) 14 of 2019, Excise Tax (Imposition of sugar tax on Drinks) Regulations, 2019.

The sugar tax applicable on drinks containing sugar content exceeding 5 grams per 100ml, including flavored milk sugar is SCR4 per liter. All importers must therefore submit a declaration containing the sugar content of the drink products upon importation for the imposition of sugar tax.

Note, sugar tax is not applicable on fresh local fruits drinks without any additives and plain milk.

Excise Duty on Exportation

Excisable goods being exported outside of Seychelles are exempted from payment of excise duty. To show proof that the excise products were actually exported, the exporter will be required to report the quantity of the exported goods in the total production. The quantity of the export goods will then be removed in the export parameter.

Record Keeping

Registered manufacturers and warehouse operators of excise goods must keep and maintain complete records of all transactions in line with the excise tax laws.

Registered manufacturers and warehouse operators must ensure their administration is organized in a concise manner and that all records of transactions are readily available when requested by the authority for a complete overview all the processes relevant collection of excise tax.

Submission of Return

A registered excise manufacturer or excise warehouse operator shall file an excise tax return, in the prescribed form and manner, for each calendar month within 21 days after the end of the month, whether or not any excise tax transactions are due for that month. The return shall be accompanied by payment of relevant taxes. taxes that need to be paid. Additional tax, charges and penalties will apply on registered excise manufacturers or warehouse operators failing to furnish a return as required under the Excise Tax Act.

Payment of Excise Tax by Registered Manufacturers

Most excise goods are subject to excise duty as soon as they are produced or imported into Seychelles. The payment of excise duty can be suspended until the product is released for consumption (that is the tax is paid when the products are released).

A registered excise manufacturer or excise warehouse operator cannot remove excisable goods from an excise warehouse if payment has not been effected unless approval has been granted as follows:

- The Commissioner of Customs have given permission for the removal of goods without payment;

- The manufacturer following the agreement of the Commissioner of Customs has increased the amount of the security given with the excise manufacturer’s bond prior to removal;

- In any other case, the manufacturer pays the excise tax on the goods before it is removed from customs control.

Destroyed Goods

Excise duty is not payable on products destroyed or lost due to unforeseen circumstances or natural disasters prior to release for consumption.

Monthly Movement Declaration

At the end of every calendar month, the registered manufacturer or warehouse operator will need to submit a report on the movements of excise goods under tax suspension within the warehouse during that particular month.

The return must contain the following details for every movement of goods:

- Movement of raw materials.

- Goods produced

- Date the movement took place.

- Source and destination.

- Details about the product and quantities moved.

Transfer of Goods under Tax Suspension from One Approved Warehouse to Another

Excisable goods can be moved from one approved warehouse to another approved warehouse as follows:

- From the entry point at customs to a bonded warehouse

- From one tax warehouse to another tax warehouse belonging to the same owner.

- From one tax warehouse to another tax warehouse belonging to different owners

- From the tax Warehouse to the customs exit point.

Application for Transfer of Excisable Goods from One Warehouse to Another

Excise manufacturers or warehouse operators wishing to move excise goods from one warehouse to another must request submit an application for approval to the Seychelles Revenue Commission (SRC) Excise Tax Unit of the Customs Division before proceeding in moving the goods under tax suspension.

The application should entail the following information:

- Source and destination warehouses.

- Estimated time of movement.

- Details of the product and quantities to be moved.

- Copies of local purchase order (LPO), credit note, pro-forma invoice and others.

Import and Export

Import

Commercial and personal goods imported into the Seychelles either for home consumption, warehousing or transshipment are entered into the Automated System for Customs Data (ASYCUDA World), that is the integrated customs management system for international trade and transport operations.

All goods are classified under the Harmonized System Nomenclature (HS Code), which is the international standardized numerical method of classifying traded products for importers, exporters, shipping and marine insurance companies.

The HS Code is used by customs authorities around the world when assessing duties and taxes plus for gathering of trading statistics.

In Seychelles, the HS Code is published under Schedule 3 of the Customs Management (Tariff and Classification of Goods) Regulations 2013 and is divided into 99 Chapters. The first 6 digits of the code are universal whilst the last 2 digits are allocated by relevant authorities in Seychelles.

Taxes Collected on Importation

The taxes collected by the Customs Division on goods imported into the Seychelles are as follows:

- Value added Tax (VAT) – The tax paid at the point of entry on all imported goods by air, sea and post.

- Excise Tax – Tax applied on excisable goods imported into the Seychelles.

- Levy – Calculated on value or quantity of imported goods and payable at the point of entry to Customs. Applicable on the importation of specifics good such as vehicles, chicken, pet bottle, plastic and canned beer.

- Customs Duty – The tax imposed on certain goods imported by air, sea and post, paid at the point of entry.

A customs declaration is an official document that lists and gives details of goods that are being imported or exported. All goods imported into Seychelles undergoes Customs procedures hence importers ensure that the correct declarations are made to Customs. When making a declaration, the importer or agent must accept the responsibilities under the customs law for the accuracy of the information and the authenticity of the documents being provided. All declarations must be made through the ASYCUDA World System by the importer or agent who must make certain to select the correct model of declaration to ensure that the correct type of control and data is made available. Bills of Entry or Bills of Export are required under the following Models of Declaration:

- EX 1 Permanent Exportation

- EX 2 Temporary Export

- EX 3 Re-export

- IM 4 Entry for home use/Ex-warehouse

- IM 5 Temporary Importation

- IM 6 Re-Importation

- IM 7 Entry for warehousing

- IM 8 Transshipment & Ship store Procedures

- SD 4 Simplified Declaration

Mandatory documents required to prepare the declaration in ASYCUDA World system which must be scanned and enclosed with the declaration by the importers or agents are as follows:

- Original Invoice – A commercial document that records the products total amount due, and the preferred mode of payment.

- Packing List – A list detailing the contents, weight, measurements of each package, box or of goods.

- Bill of Lading or Airway Bill – Issued by carrier providing details such as the weight of the cargo, port of loading or origin, name of airline or vessel, exporters information, terms of freight payment either prepaid or freight collect.

- Insurance Certificate – Document covering the consignee in case of potential loss or damage experienced to the cargo.

- Import Permit (if applicable) – Document required for importation of prohibited and restricted goods.

It is the responsibility of all vessels and aircraft or their appointed agents, arriving from a destination outside of Seychelles to deliver a cargo manifest to customs detailing all the goods being carried. The carrier has to submit the cargo manifest at least 24 hours before docking or 3 hours before landing.

Upon request of the carrier, customs can allow amendments to the manifest within 24 hours following registration of the manifest in the ASYCUDA World System and offloading of all cargo.

In cases, where the goods land in a damaged state, the carrier or agent must submit to customs a ‘Damage Report Form’ providing details of the damaged goods.

Upon arrival of the goods, if there are any shortage or excess goods, the carrier must within 24 hours request for the appropriate amendment to their manifest together with the supporting documents.

It is the responsibility of the carrier or agent to request for the amendments as the Bills of Lading and Airway Bills will automatically be blocked, thus delaying the cargo release process as the clearance of goods will not be possible until the differences in the cargo amount has been properly documented.

Concessions on importation are available for certain industries such as the tourism, fisheries, agriculture, education and others as approved by respective ministries or agencies.

The bill of entry for industries where concessions has been granted will either be stamped or supported by a letter as proof of approval by respective ministries or agencies. This process also applies to some specific exemptions in the case of class and category of people whereby the approval or authorization of the parent agencies or ministries is required.

For customs to allow the concession or exemption:

- The bill of entry, invoice, bill of lading or airway bill must be in the name of the organization entitled or eligible for the exemption.

- A copy of the endorsed bill of entry or letter must be submitted to customs before payment of the applicable tax liability.

Companies under the Seychelles International Trading Zone (SITZ) administered by the Seychelles Financial Services Authority (FSA), are covered under an agreement which allows them to manufacture or import goods for sale overseas or to certain industries such as the tourism and hospitality sector in Seychelles.

Documentation for the goods entering and exiting the trade zone are presented to customs and applicable taxes are collected when the goods are placed under home use procedure, if not exported.

Customs provides direct release for clearance of ‘Urgent Goods’ or ‘Consignments’, that is goods or cargo requiring special treatment due to their nature, condition or use, to agents or importers with declarations containing only products considered as ‘Urgent Goods’ as follows:

- Perishable – Food and Medicine.

- Aircraft and Ships Spares.

- Hazardous Products.

- Human Remains.

- Bank notes and Coins.

Below is the complete list of goods for direct delivery.

Payment Procedure for Direct Release of Goods

Agents or importers requesting for direct release of ‘Urgent Goods’ must hold a pre-payment account with the Customs Division of the Seychelles Revenue commission (SRC). to facilitate the payment of duties and taxes following the direct release of goods.

To open a pre-payment account, the importer must complete the pre-payment account application

form requesting access to this facility of which once activated, the importer or agent will be able to deposit money

into the account for automatic payment of any tax liabilities. The account once activated will be directly linked with the importer or agents’

tax identification number.

Procedure to Follow Before Arrival of Goods

24 hours prior to the arrival of the ‘Urgent Goods’ the agent or importer must input all the required

information in the declaration, except the cargo manifest reference which can be added later to the Bill of Entry.

The importer or agent must complete the Bill of Entry using the declaration type IM4 including the national code ‘PER’ for every item, in addition to enclosing all the scanned mandatory documents

such as the e-permit for restricted goods as applicable with the registered Bill of Entry in ASYCUDA World.

Following this process, Importers or agents can request for validation of their declaration by customs to

evaluate their documents to allow their goods to be released upon arrival.

Procedure to Follow After the Release of Goods

The importer of agent must complete the missing information on the Bill of Entry within 48 hours following the direct release of goods. This process is important as after the aforementioned timeframe

ASYCUDA World will stop issuing automatic release after two (2) incomplete Bills of Entry.

Importers must also ensure that sufficient balance is available in their pre-payment accounts to cover the total amount of duties and taxes payable on the Bill of Entry, as any unpaid Bill of Entry will be reported

as “not complete” in ASYCUDA World which can cause delay in the release of their next shipment.

Prohibited and Restricted Imports

Prohibited imports are goods which are banned completely from entering the country (such as illicit drugs)

whereas restricted imports refer to goods requiring an import permit to enter the country (such as fresh flowers).

Used personal and household effects are goods owned, possessed, and used by a person for a period of 12 months or more, at another destination other than their country of residence.

Used household effects are normally items required at home in order to facilitate a comfortable living environment whilst used personal effect are used items such apparel, jewelry, photographic equipment and others. Used household effects exclude motor vehicles, merchandise goods or new household items brought on a travelling trip sent by cargo as well as CFC’s gases R12 and R22.

Importation of personal and household effects are exempted from payment of taxes, however the importer must ensure ownership, possession and usage of the effects. For example, if the importer has owned and possessed a particular item but has not used it yet, the item will be subjected to regular taxes upon importation.

Importers are thus recommended to keep receipt of all goods purchased to share with Customs Officers upon request and to seek the necessary permit from the Ozone Office (Ministry of Environment, Energy & Climate Change) before importing any refrigerant gas or equipment into the country.

Persons Exempted from Payment of Import Taxes

The following persons are exempted from payment of import taxes on their used personal and household effect as follows:

- Returning resident (Citizen of Seychelles).

- Expatriate.

- Returning students and graduates (citizens studying abroad for a continuous period of 12 months).

- Other visitors or passengers changing residence.

- Diplomatic Corps establishing permanent residence.

Clearance of Used Personal and Household Effects

Documents needed for clearance of used personal and household effects are as follows:

- Unaccompanied personal effect statement form.

- Bill of Entry (2 copies).

- Invoices and receipts of effects.

- Bill of Lading or Airway Bill.

- Packing list.

- Copy of passport showing proof of exit from Seychelles for more than 12 months as well as the most recent entry back into the country.

- Import or work permit (as applicable).

- Letter from the sponsoring organization certifying the student or graduate was studying overseas or documents showing proof of institution attended during the duration of study if the graduate has been self- financed.

Tax Payable on Importation of New Household Effects

Applicable taxes and duties will be imposed on all new household items being imported into the country. In the case of a person transferring from his or her place of residence to the Seychelles, following request in writing and approval from the Commissioner of

Customs a concession of SCR 1000 can be granted per person on the value of the new household effect.

All motor vehicles imported into the Seychelles must be right hand drive and requires an import permit prior to arrival in the Seychelles. However, there are restrictions on the importation of certain vehicle parts falling under those categories:

- Vehicle and chassis bodies for example fork-lift, trucks, cranes, and derricks.

- Spark-ignition piston engine of kind used for the propulsion of vehicle for example bulldozers, graders, excavators, scrapers and shovels.

- Compression piston engine (diesel or semi diesel engine) of kind used for propulsion of vehicle for example chassis fitted with engine.

- Bodies (including cabs, for motor vehicles) for example nose cuts, front cuts, and rear cuts.

Importation of Vehicles by Returning Graduates and Residents

The computation of applicable duties and taxes on used motor vehicles imported by returning graduates or residents shall be based on the net book value of the vehicle.

There is no concession on importation of vehicles for returning graduates or residents, all applicable taxes and levy remains payable.

The returning graduate or residents must import his or her new or used motor vehicle within 6 months upon taking residency into the Seychelles subject to the following conditions:

- The vehicle must be right hand drive and must not be older than 3 years.

- The motor vehicle must be for passenger use only as classified under HS Code 8703 and motorcycle HS Code 8711.

- Only one vehicle can be imported per graduate or resident age 18 years and above.

- Once imported into the country, the motor vehicle or motor cycle must be registered on the importer’s name and must not be permitted to be sold or transferred for a period of two years following registration at the Seychelles Licensing Authority.

- Should the importation fail to meet this policy, Customs Division shall take actions provided under the appropriate legislation.

Goods imported by post must be accompanied by a customs declaration form CN22 or CN23 which provides the description and value of the goods and also determines the purpose of the good that is if it’s a personal or a commercial good.

The parcel will generally be opened in the presence of the consignee, however in certain circumstances the parcel may be opened and examined by a Customs Officer in the presence of a Police Officer and a representative of the Seychelles Postal Services.

The customs declaration form will assist the customs officers to determine the amount of duty and taxes to be paid in case the imported good is a dutiable item. In some circumstances customs may require additional information or documents from the consignee to make a satisfactory assessment of the tax liability before the parcel is cleared. The liable duty and taxes have to be paid before the parcel is released to the consignee.

- Restricted goods.

- Commercial goods.

- Personal goods in excess of SCR 5000.

- Temporary imported goods.

Goods Imported by Post Requiring a Bill of Entry are as Follows:

- Goods re-entering Seychelles following repairs or replacement.

- Exported goods where payment of VAT and import duties has been paid at the point of entry and the goods has been re-imported by post.

Goods Re-entering Seychelles Requiring Endorsement of Customs

Passenger Guide

Duty Free Allowances

Passengers entering the Seychelles are allowed to bring a given value of imported goods as accompanied luggage including perfume, alcohol and tobacco on which payment of taxes and duties are exempted.

Passengers aged 18 years and above are allowed the following duty free allowances:

- 200ml of perfume and eau de toilette.

- 2 liters of alcoholic beverages containing less than or equal to 16% alcohol such as beer, wine and sparkling wine.

- 2 liters of alcoholic beverages containing more than 16% alcohol such as whisky, rum, gin and fermented or distilled liqueur.

- 250 grams of tobacco product or 200 cigarettes including but not limited to cigars, cheroots, snuff, smoking and chewing tobacco.

- SCR 5,000 worth of other goods (for passengers aged over 18 years of age)

Passengers below 18 years are entitled to carry SCR 3,000 worth of other goods into the Seychelles including item 1 from the duty free allowances list only.

Note, duty free goods must be for the personal use of the passenger only and must not be intended for sale or used as tradable or commercial goods.

For more information about duty free allowances please view the SI 23 2022 – Customs Management (Passenger Allowance) (Amendment) Regulations 2022

Excess Duty Free Items

Passengers carrying items in excess of the required duty free allowance will be subject to payment of the applicable taxes upon arrival. The tax payable will be calculated based on the invoices or receipts produced upon request or on the customs value.

In cases where the passenger decides to dispose excess goods at the Airport Terminal, Customs will consider the goods disposed as the acceptable duty free allowance, whilst any remaining goods will be considered as the excess allowance on which applicable taxes will apply.

Passenger Clearance Procedure

Passengers expecting a smooth clearance at airport upon arrival are reminded not to bring any prohibited goods, excess duty free allowance or carry any items that does not belong to them.

There are two channels to choose from at the airport as follows:

- Red customs channel – For passengers with “GOODS TO DECLARE” for example goods that are liable to duties and taxes, or goods requiring special permits.

- Green customs channel – For passengers having “NOTHING TO DECLARE” or do not possess articles or goods that are restricted or in excess of the admissible duty-free allowance.

Passenger’s Obligations Under the Customs Management Act

Passengers arriving in the Seychelles must:

- Allow customs to examine their luggage and goods, in addition to answering any questions demanded by a Customs Officer.

- Open, unpack and repack any luggage for and after the end of examination by Customs Officers.

- Produce any requested records or documents related to the goods brought into the country.

- Declare goods that are in excess of the duty free allowance and under the restricted and prohibited category.

- Pay the appropriate duties and taxes on the value or quantity of goods exceeding the allowance.

Note, it is a serious offence not to declare goods in quantities or value in excess of the allowable concession. If in doubt, passengers are advised to proceed to the red customs channel to avoid the imposition of heavy fines, penalties, seizure of goods and possible criminal prosecution.